Marketplace iOS

Designed Experian's iOS Marketplace, transforming complex credit offerings into a clear, insight-driven experience that guides users toward better financial decisions.

Company

Experian Consumer Services

Year

2020

Category

Product Design

Role

Lead designer

Overview

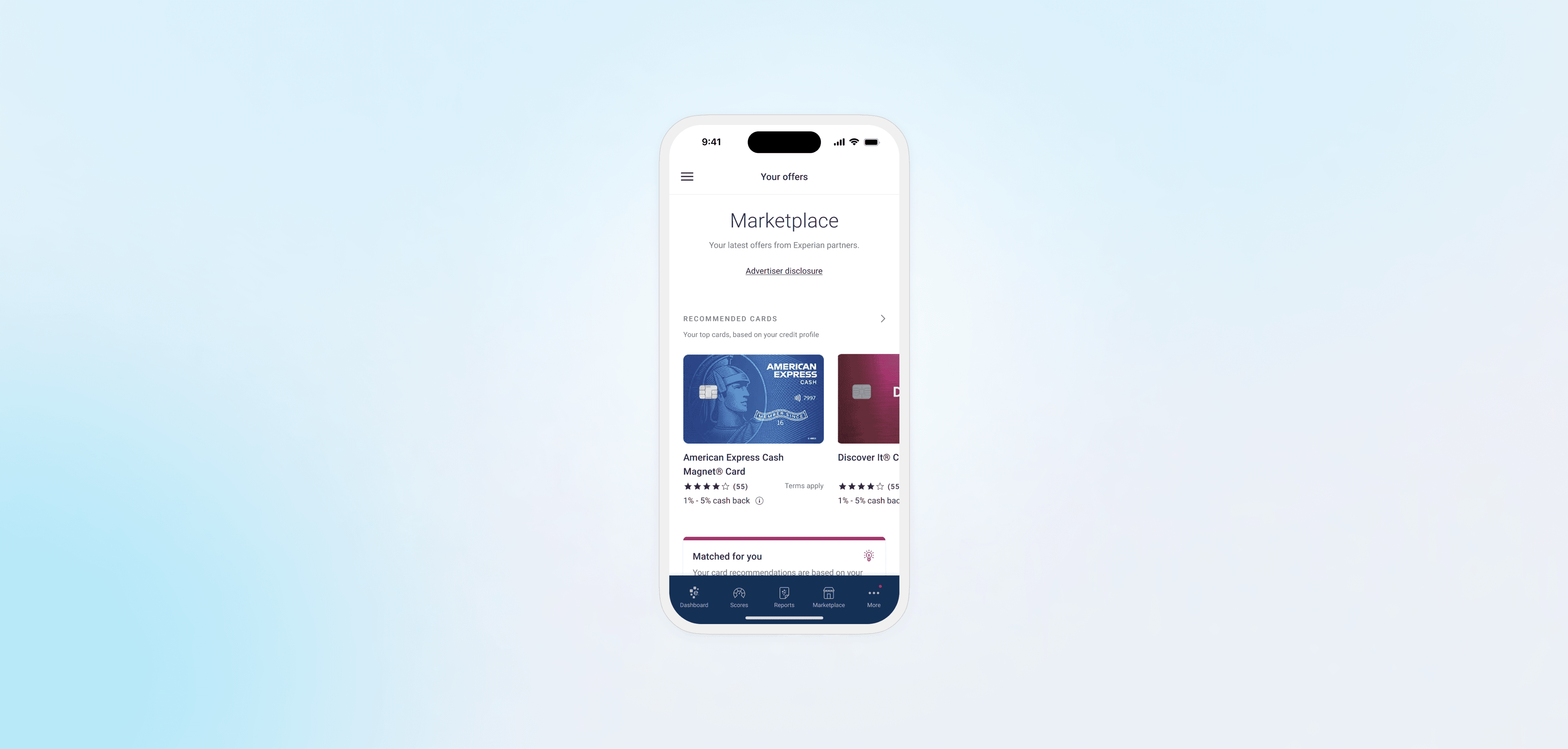

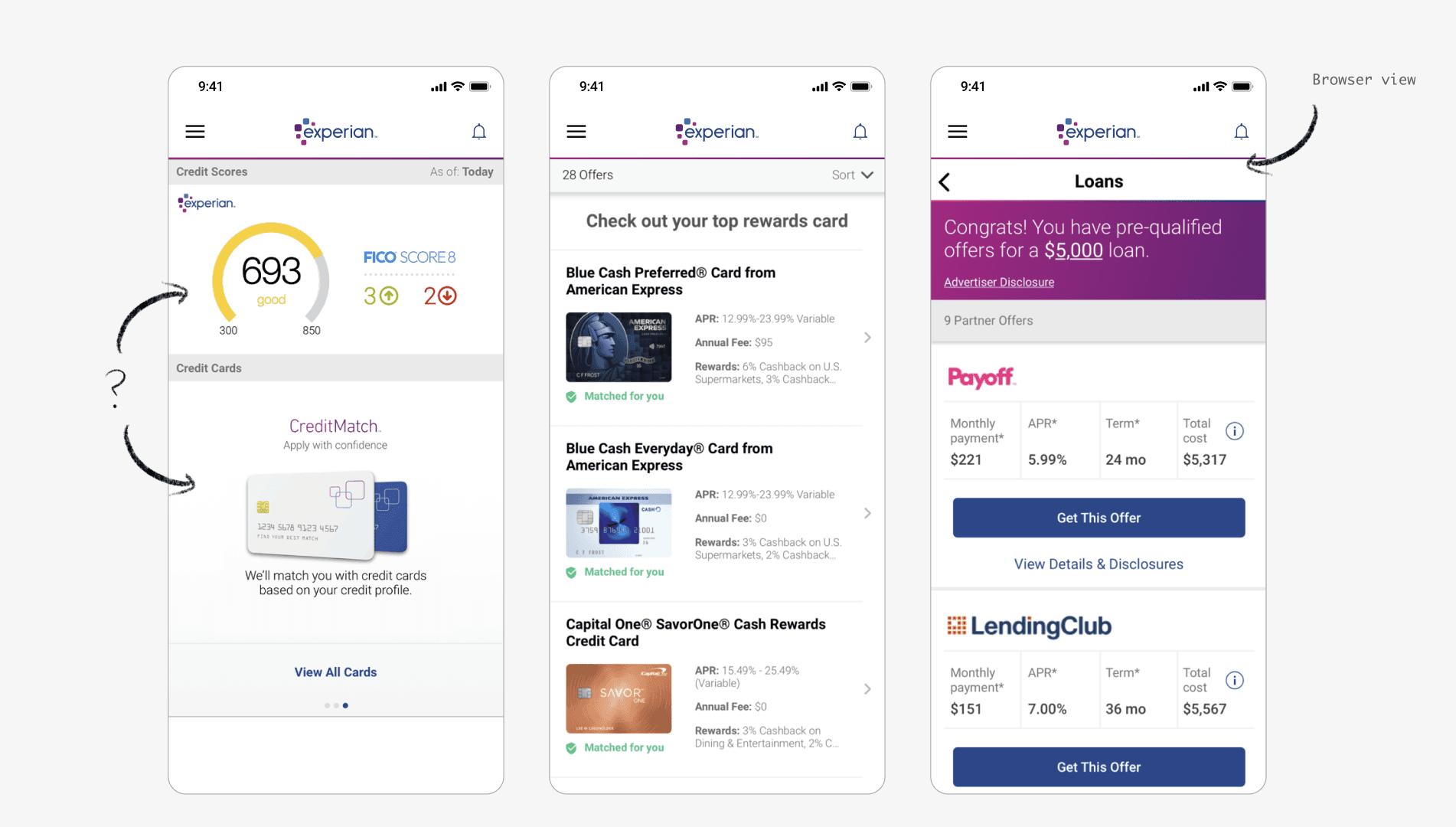

I designed Experian's first iOS Marketplace, transforming what could have been a simple product listing into a guidance-focused platform that puts consumers first. By integrating personalized insights with credit product recommendations, we helped consumers understand which financial products could actually improve their credit health and why. The new experience resulted in higher user engagement and better-informed financial decisions, while maintaining strong business performance.

The problem

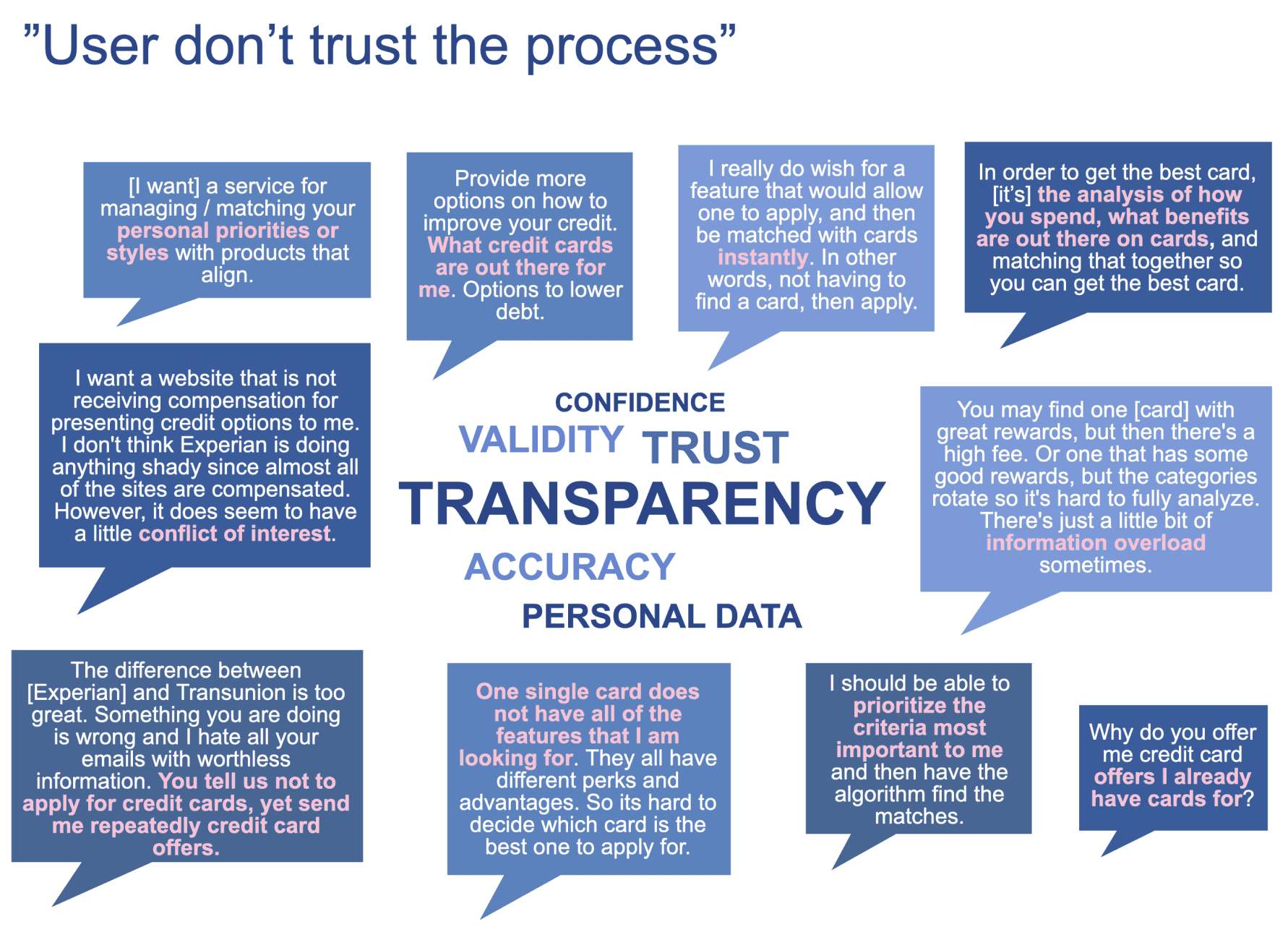

When consumers came to the iOS app, they're only here for one thing, and that one thing is their credit score. Instead, they're typically faced with a credit card offer right below their score. For consumers who are struggling and appear to have a significantly low score, credit card offers aren't the most pleasant thing to look at. Instead, it seems insensitive and pushy.

Many consumers aren't aware of how credit cards and loans could actually improve their financial health. Many viewed their credit score as a fixed number rather than something they could actively improve.

Through research, we uncovered two critical insights:

Users in the low-to-mid credit score range felt overwhelmed and unprepared to make decisions about credit products.

Young consumers, often influenced by cautious parental advice, were missing opportunities to build credit early in their financial journey.

The real challenge wasn't just presenting credit products (duh)—it was helping consumers understand how these tools could create positive financial opportunities in their lives.

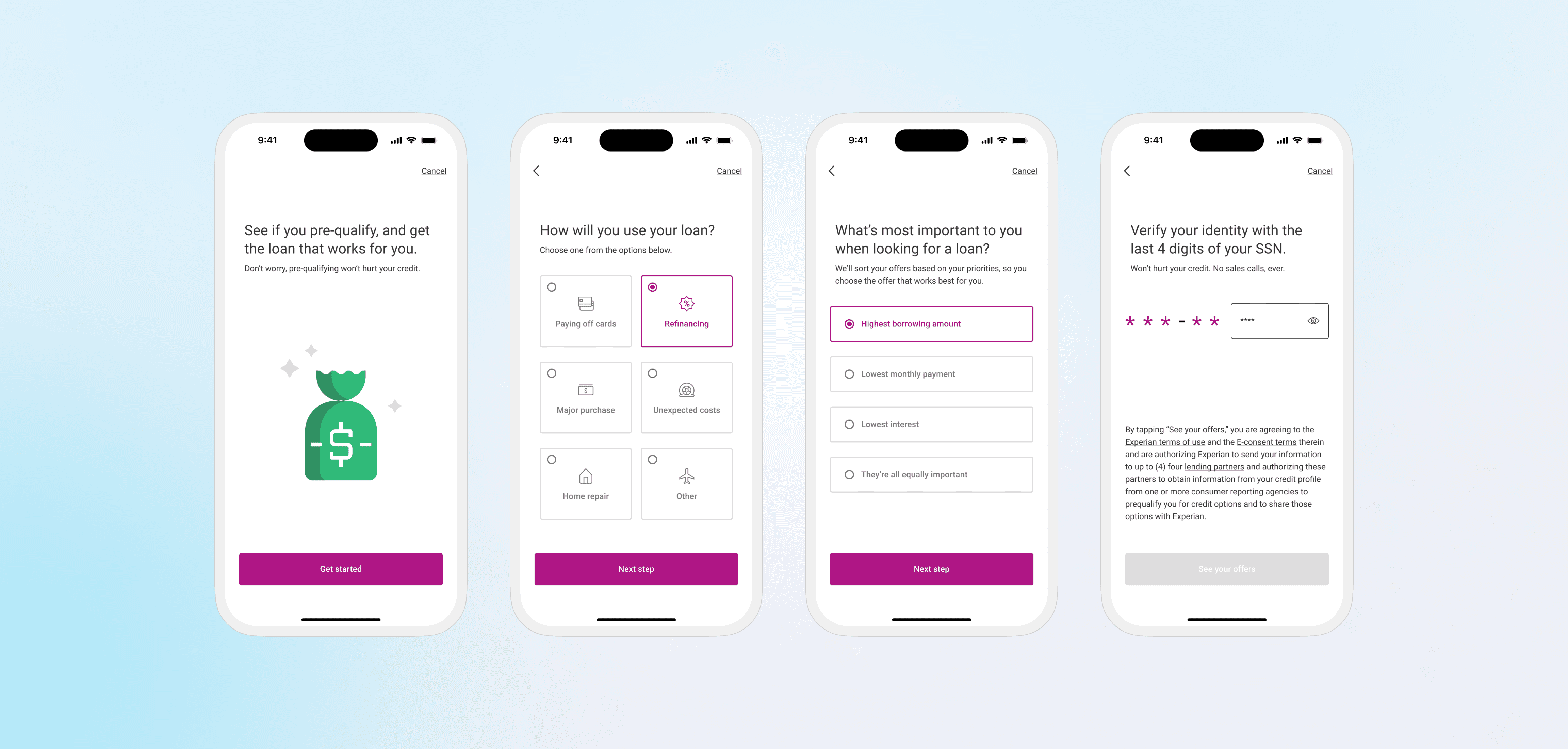

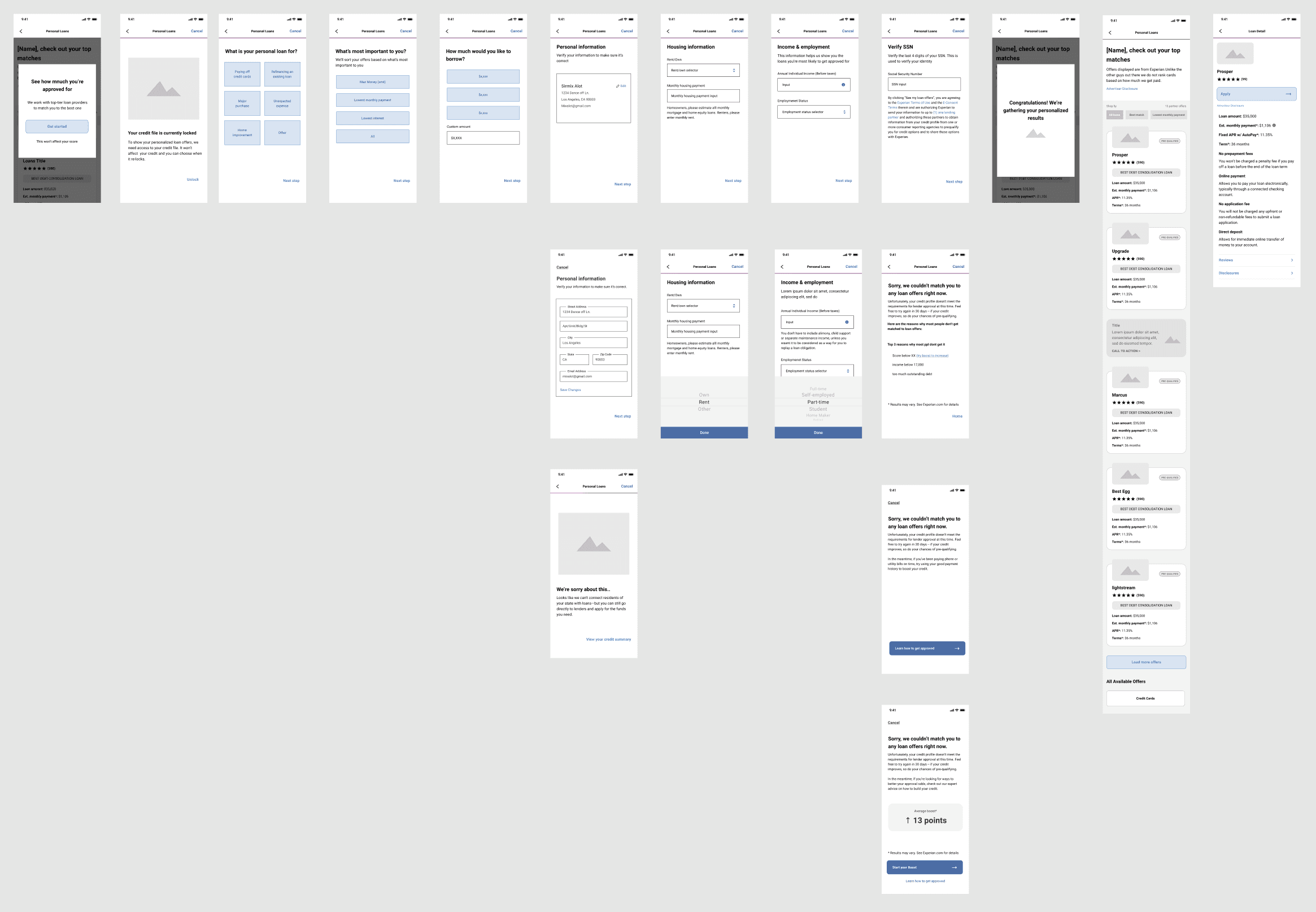

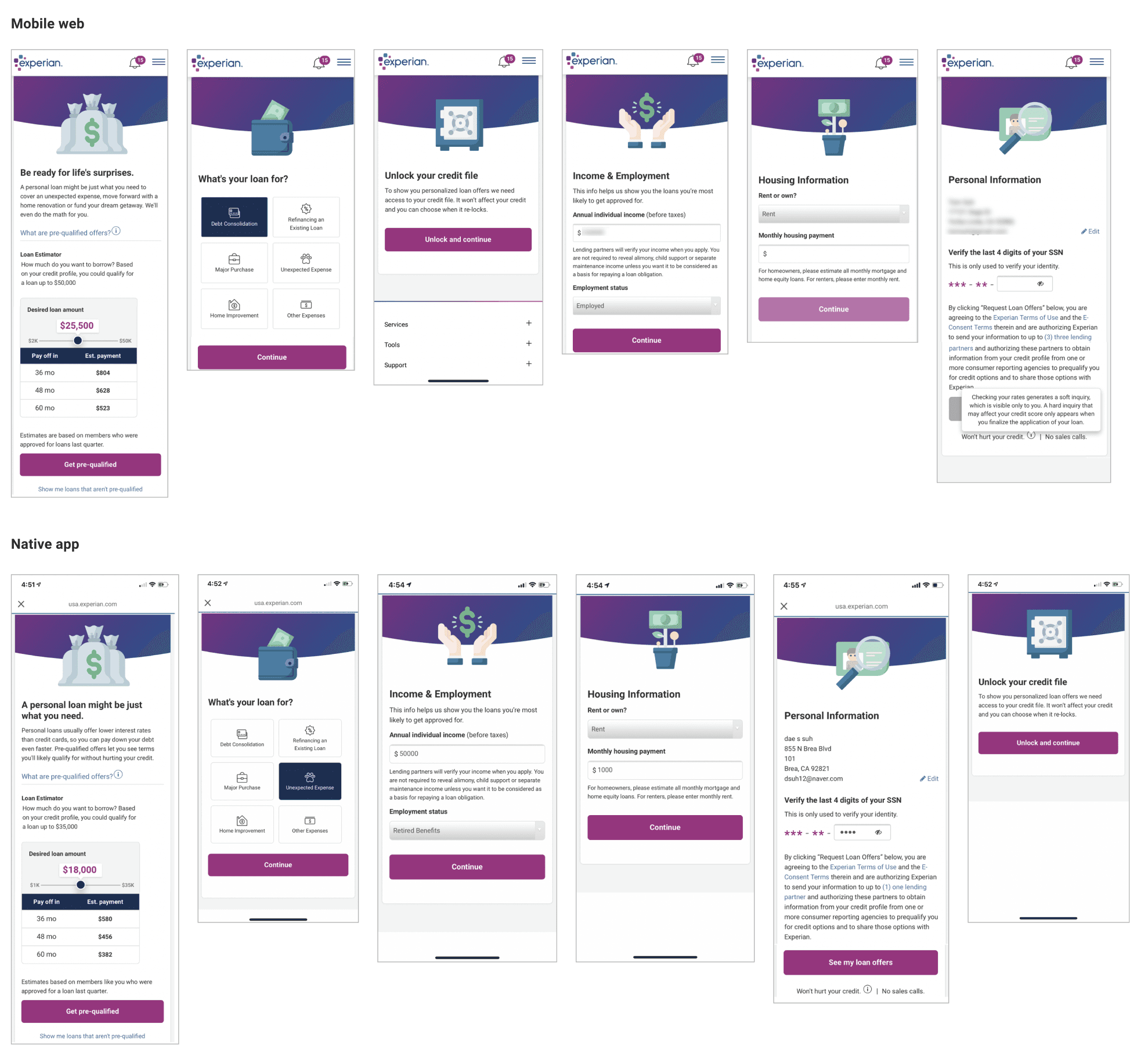

This is the current design for the pre-qual flow on the web. However, it feels far too complex and doesn't align with iOS patterns. How can we make this better and allow for the consumer to digest information quickly and get through the flow quickly?

The solution

Through interviews and usability testing across different credit score segments, key opportunities were identified to transform the Marketplace experience:

Educational integration:

Introduced Experian blog posts within the app for the first time, providing contextual financial education

Collaborated with financial education experts to create targeted content that addressed specific knowledge gaps

Positioned educational content strategically alongside product offerings to help users make informed decisions

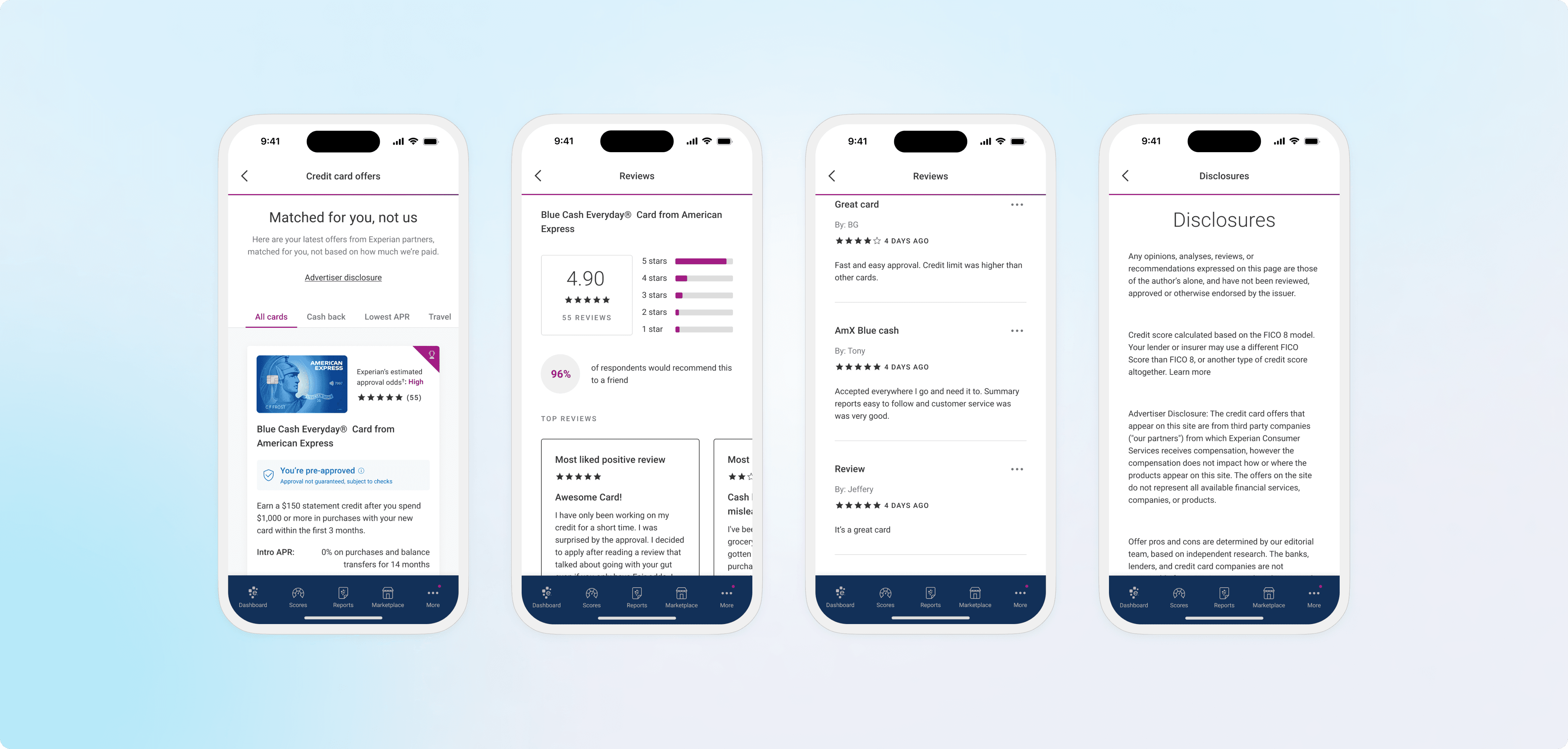

Personalized recommendations:

Created a guided experience that helps consumers understand why specific products are recommended for them

Integrated educational checkpoints throughout the user journey to build financial confidence

Social proof:

Maintained and enhanced the review system to help consumers make more confident decisions

Structured reviews to highlight real user experiences and outcomes

Focused on surfacing relevant reviews that match users' financial situations and goals

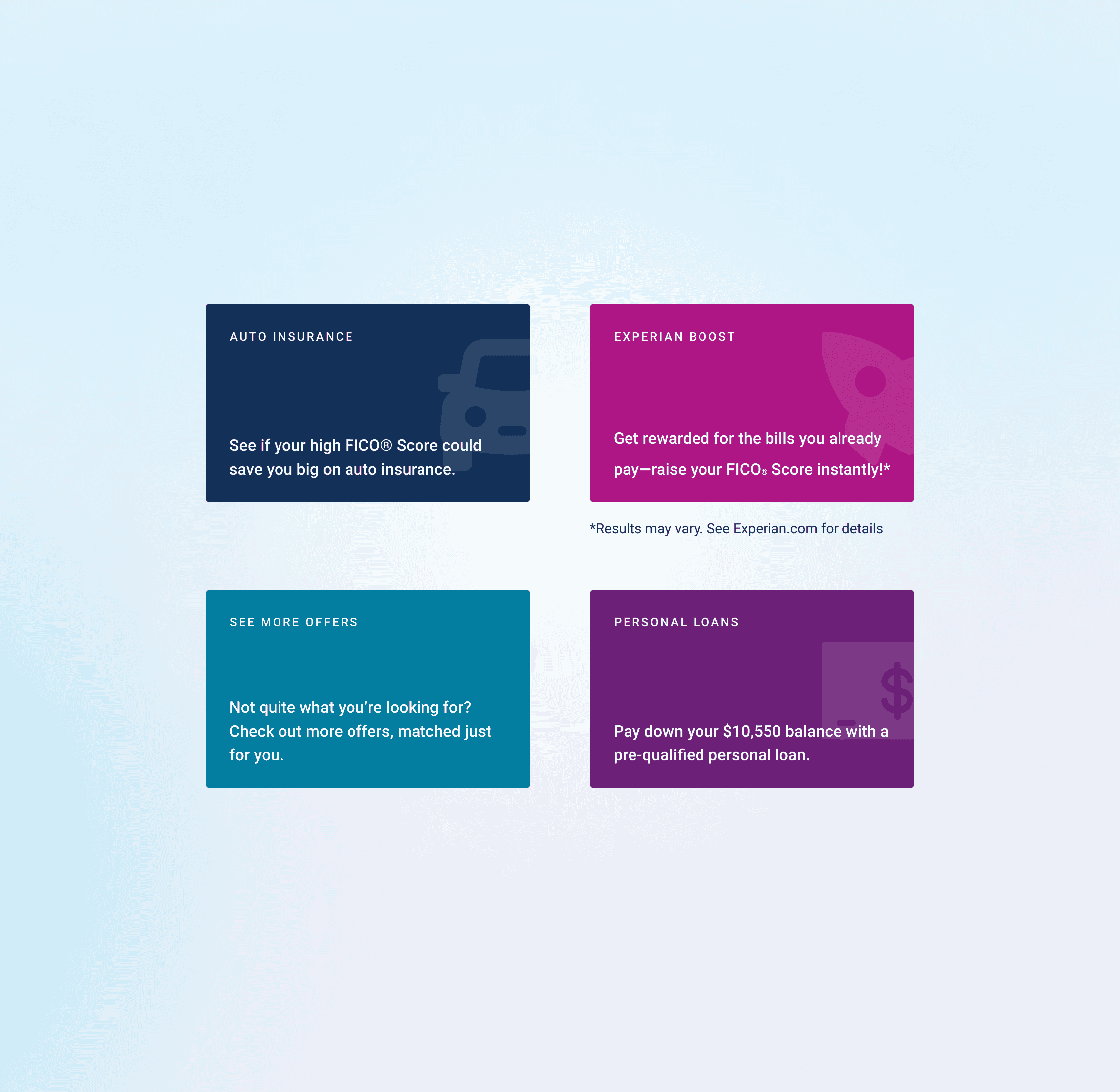

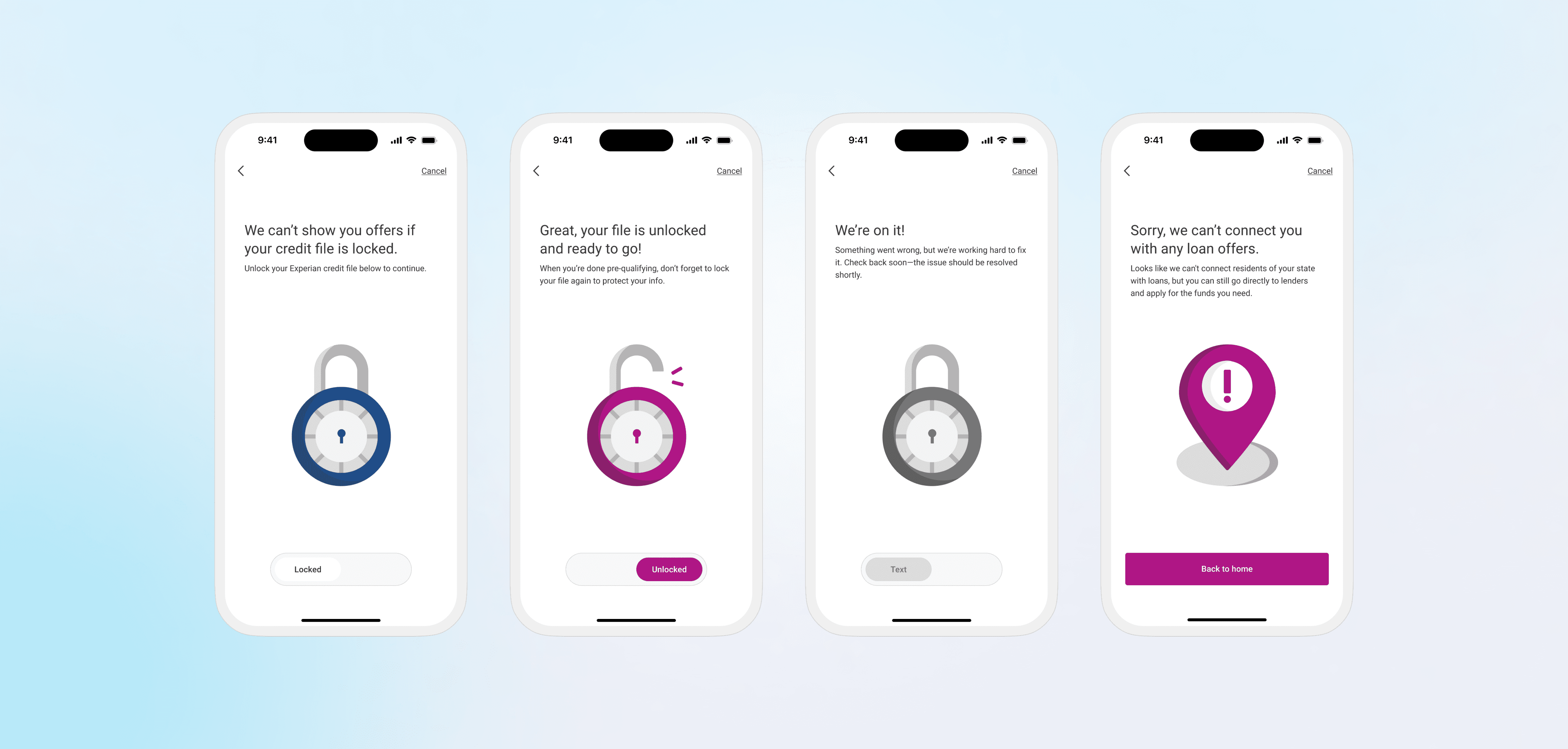

Strategic feature integration

Surfaced the personal loan pre-qualification tool in the main marketplace, expanding its reach to 1.8MM daily active users

Streamlined the pre-qualification process with an intuitive, step-by-step flow that follows iOS design patterns

Integrated loan offerings seamlessly into the Marketplace, making it easier for users to discover and engage with loan products

The outcome and impact

The reimagined Marketplace transformed how Experian connects users with credit products, creating lasting impact for both consumers and the business:

User-centered achievements:

Pioneered an education-first approach to credit product discovery

Integrated financial education directly into the product journey, helping users make more informed decisions

Designed an intuitive pre-qualification flow that simplified complex loan processes

Business impact:

Achieved significant increase in conversion rates, directly contributing to bottom-line growth

Successfully integrated educational content with product offerings, exceeding internal engagement goals

Created a scalable foundation that continues to serve Experian's 1.8M daily users today

Established a new standard for how Experian presents credit products to consumers

Long-term impact:

The Marketplace continues to evolve and grow on the foundation we built, maintaining its core mission of empowering users to improve their credit health. This project established a new paradigm for how Experian approaches product education and recommendation, shifting perception from a credit reporting agency to a trusted financial partner. 🤝

Key learnings:

Demonstrated how consumer education can coexist with business goals, creating value for both

Proved that simplifying complex financial processes increases user engagement and conversion

Showed how strategic feature placement and educational content can transform user behavior

The success of this project has influenced Experian's approach to product development, setting a new standard for how financial services can be both educational and engaging.