What's Changed?

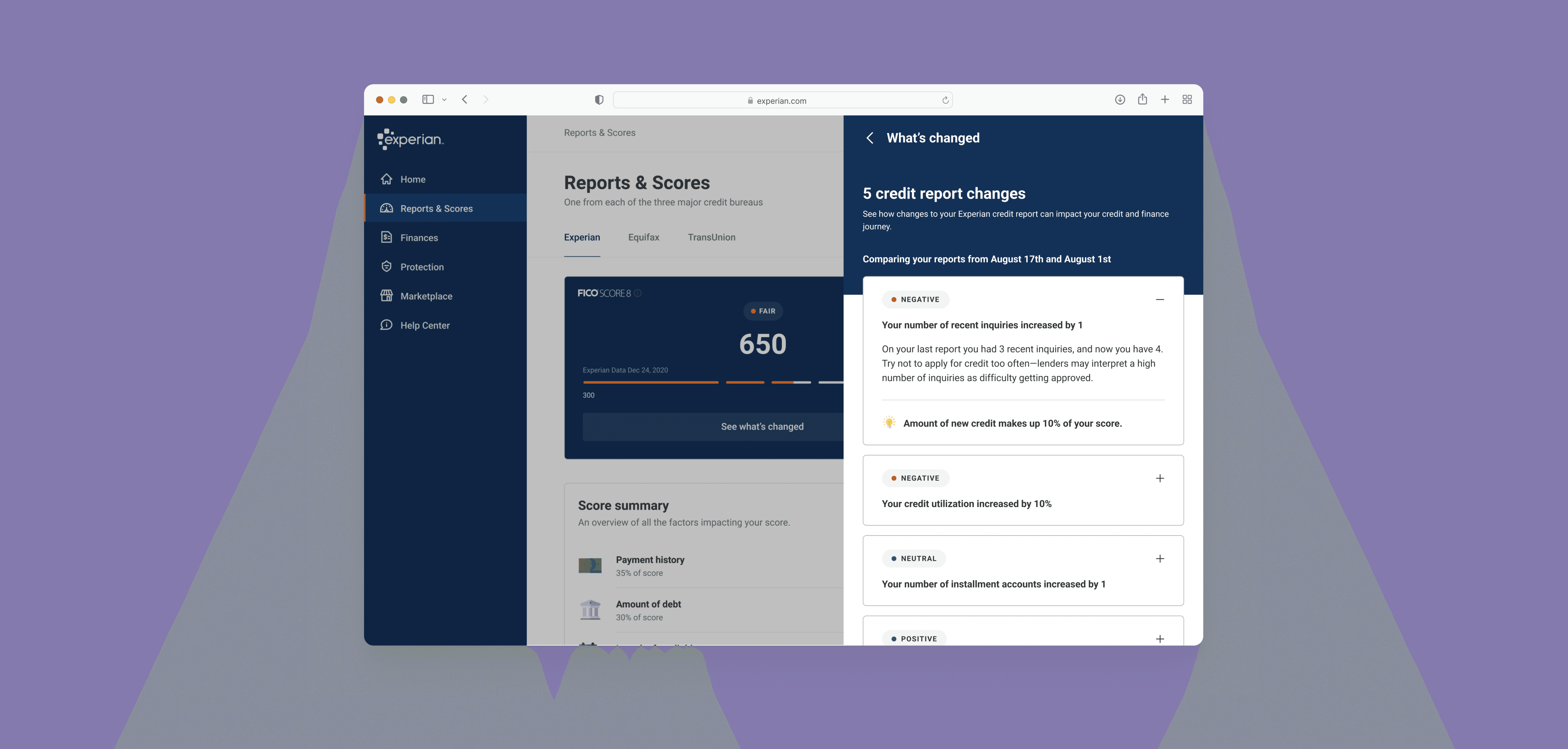

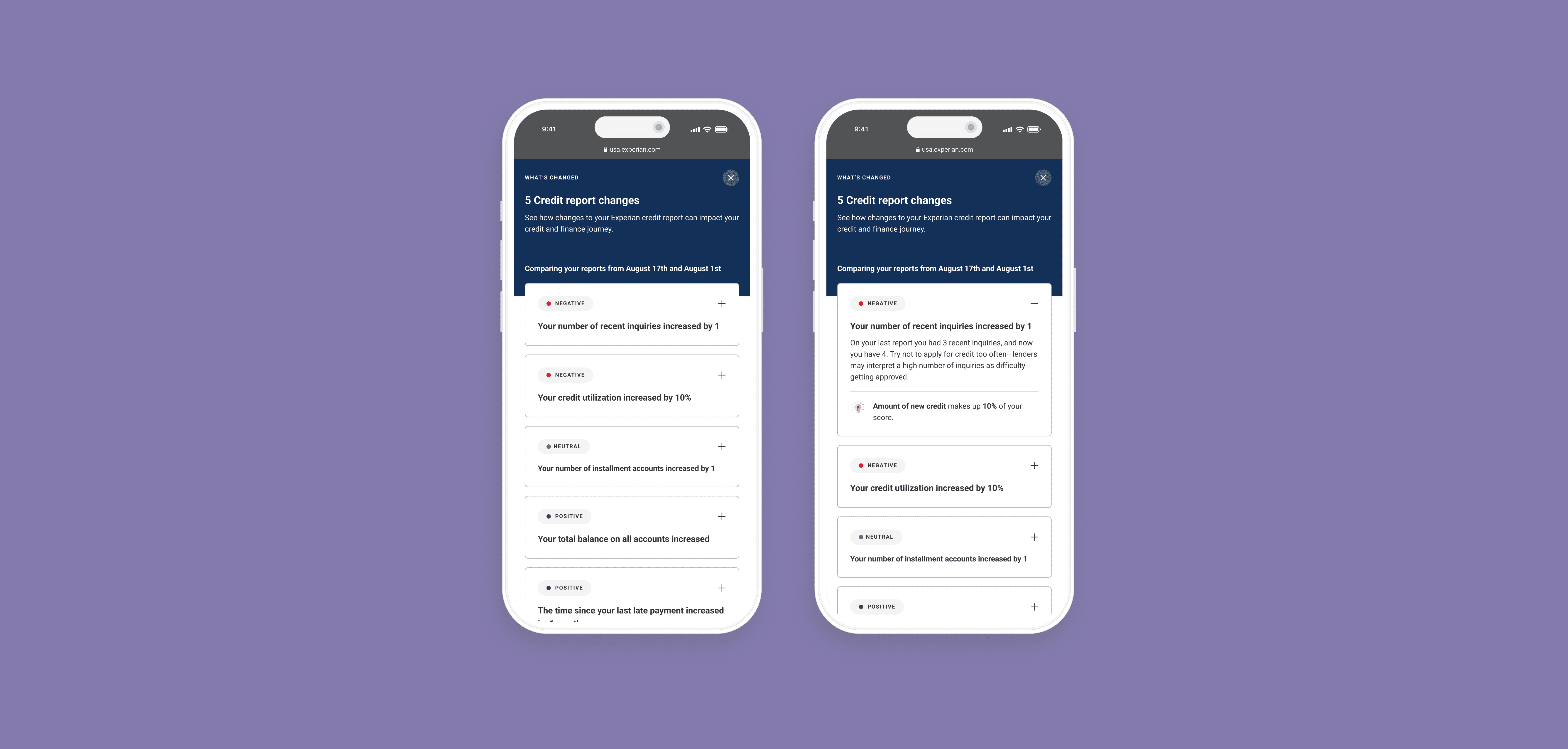

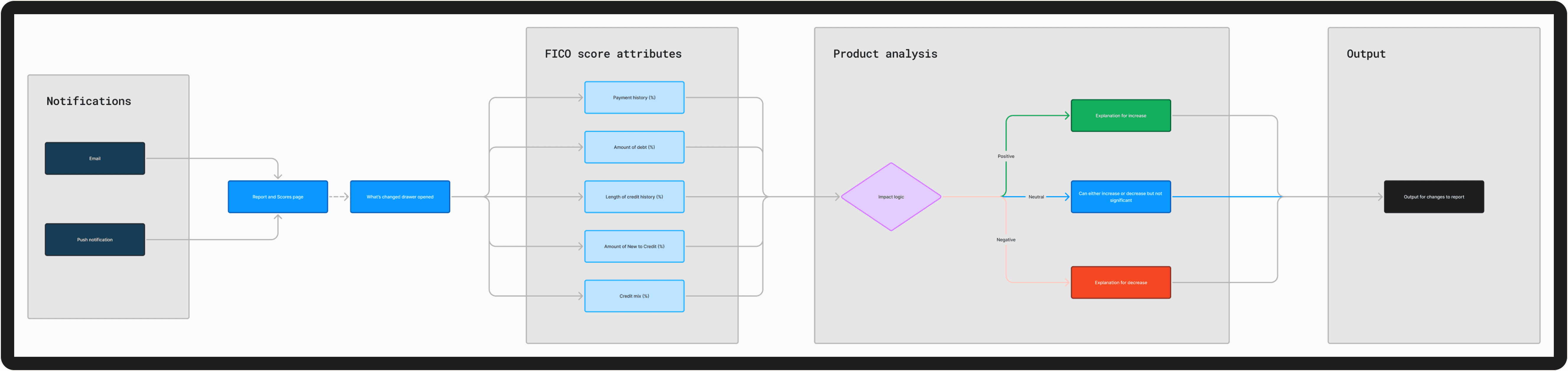

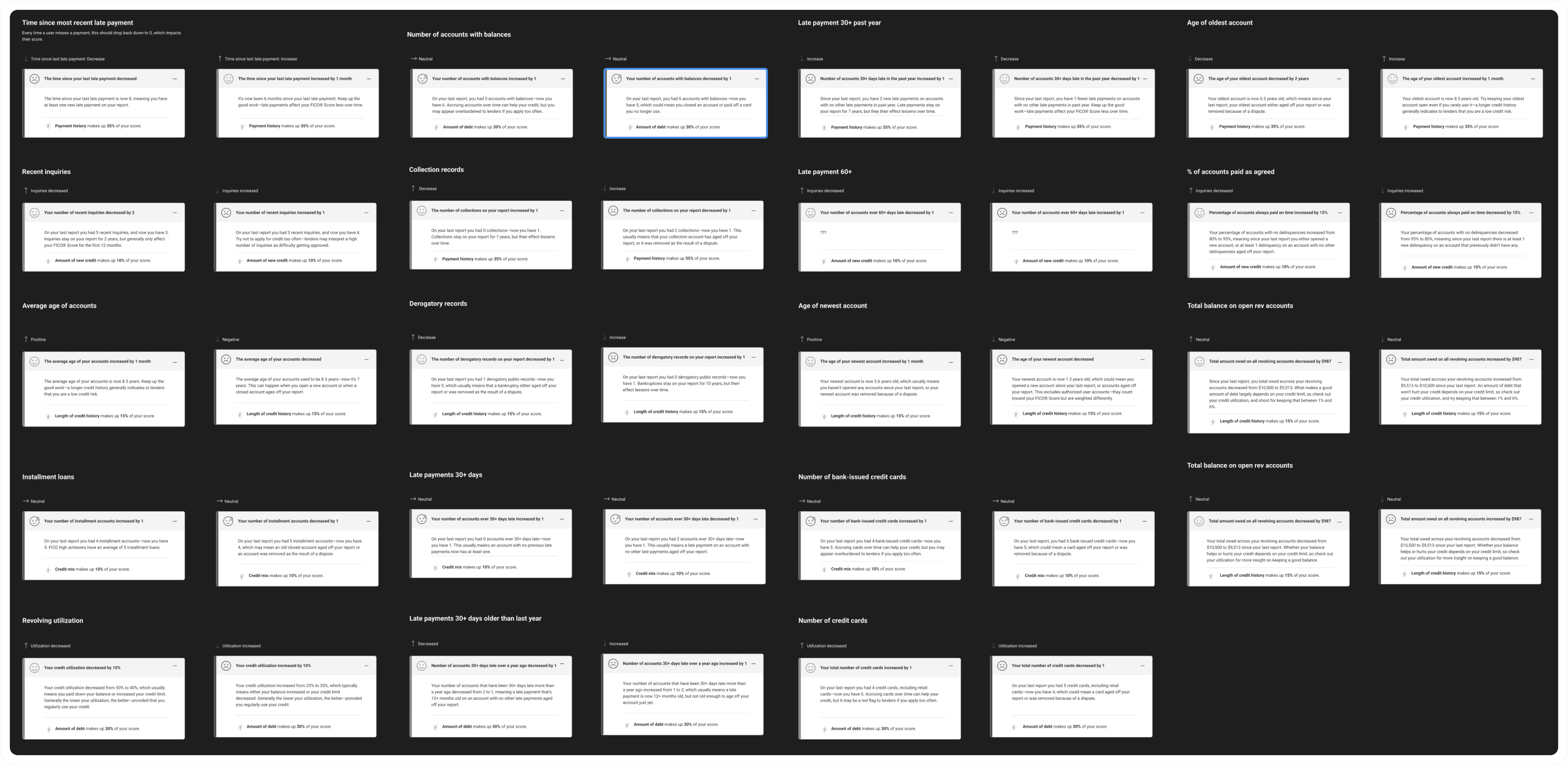

The 'What's Changed' feature in the Experian app helps users understand why their FICO Score changed by pinpointing specific factors and providing clear explanations to help improve their credit.

Company

Experian Consumer Services

Year

2020

Category

Product Design

Role

Lead designer

Overview + the problem

Imagine your credit score drops

Imagine checking your credit score and seeing it dropped 20 points, but having no idea why. This was the frustrating reality for many Experian app users—unexpected changes with unclear explanations. This was the frustrating reality for many Experian app users—unexpected changes with unclear explanations. The 'What's Changed' feature transforms this confusion into clarity by showing exactly what impacted their FICO Score, whether it was a missed payment, higher credit usage, or a new account. Instead of generic advice, users now get personalized insights that help them understand and improve their credit with confidence.

The solution

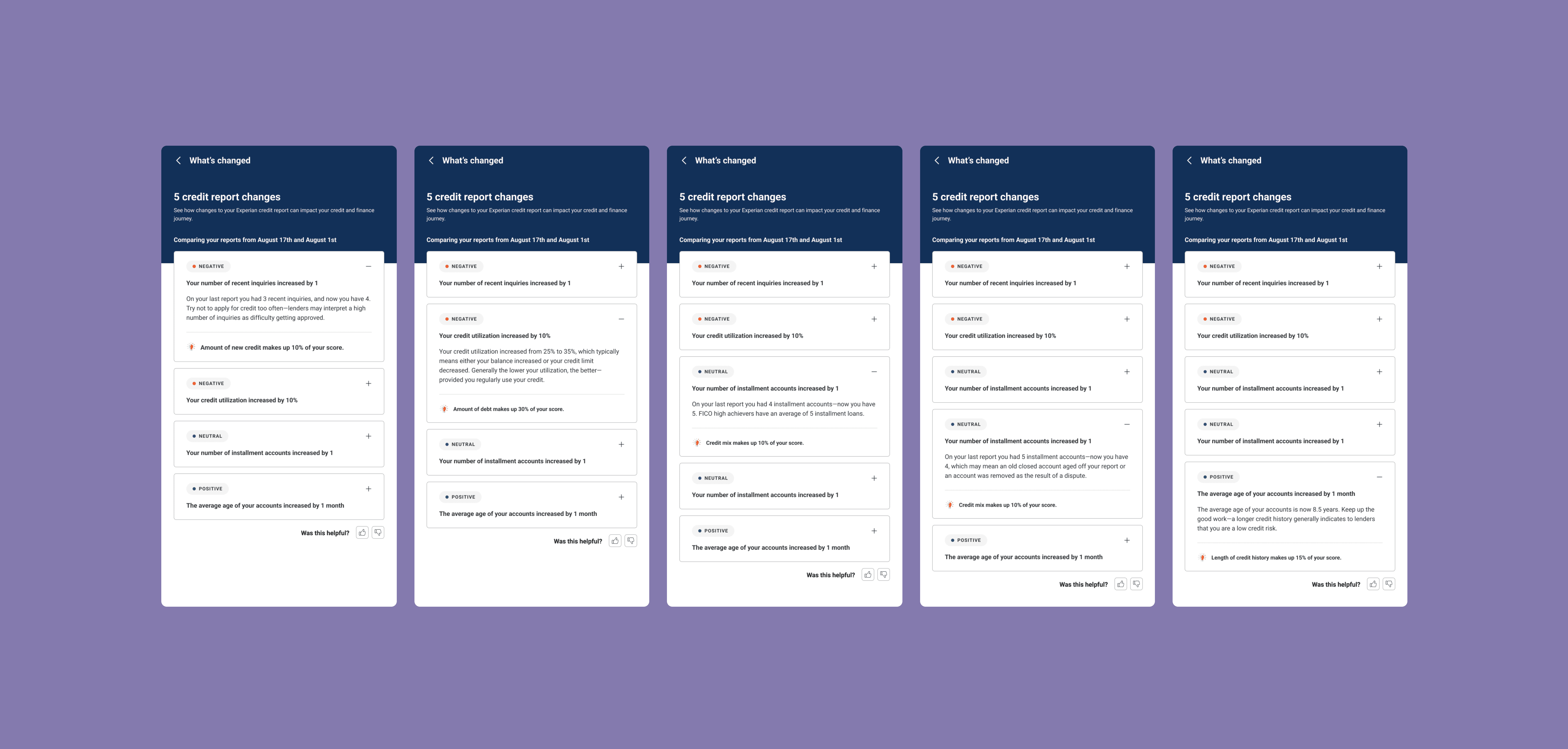

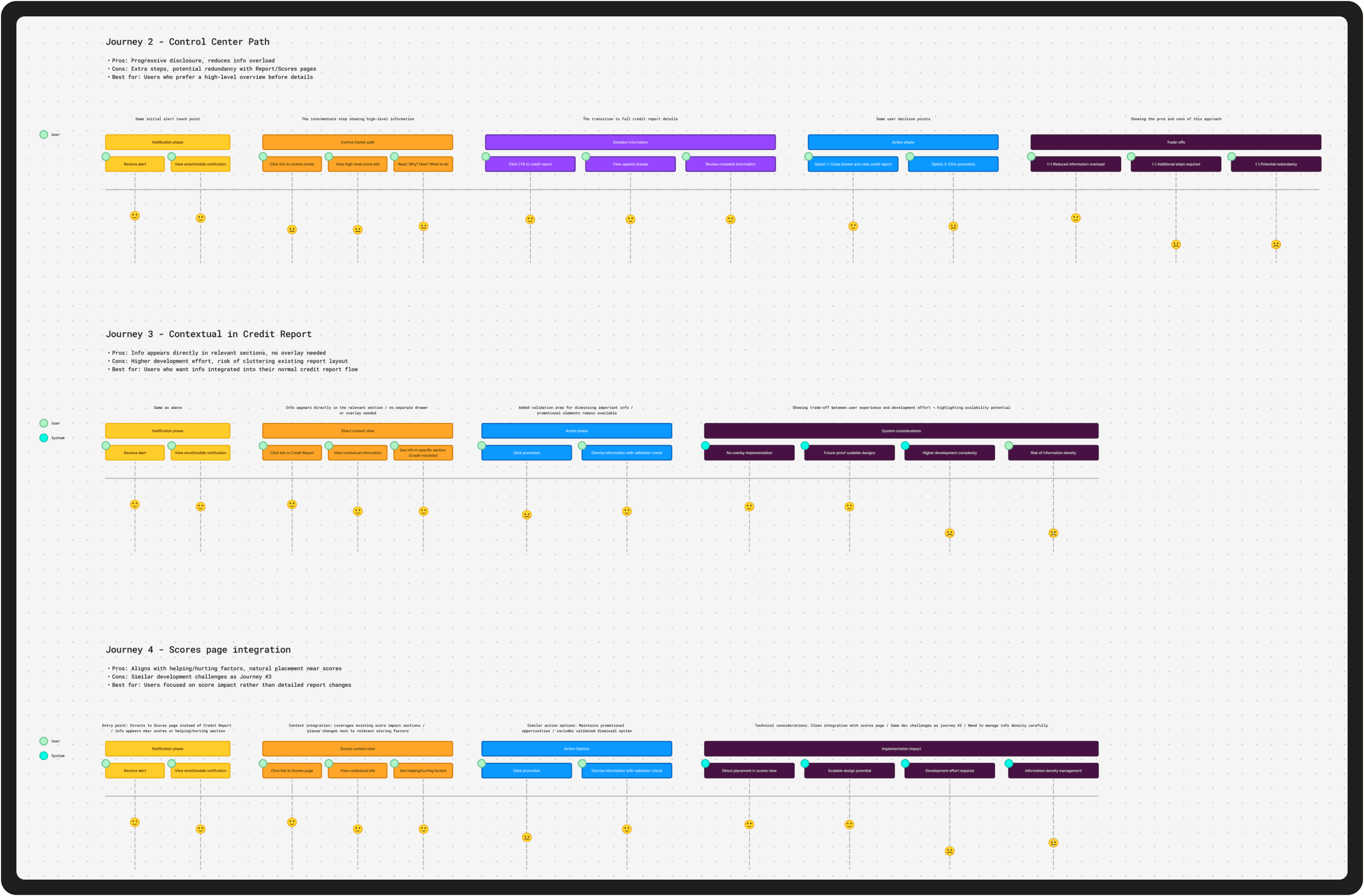

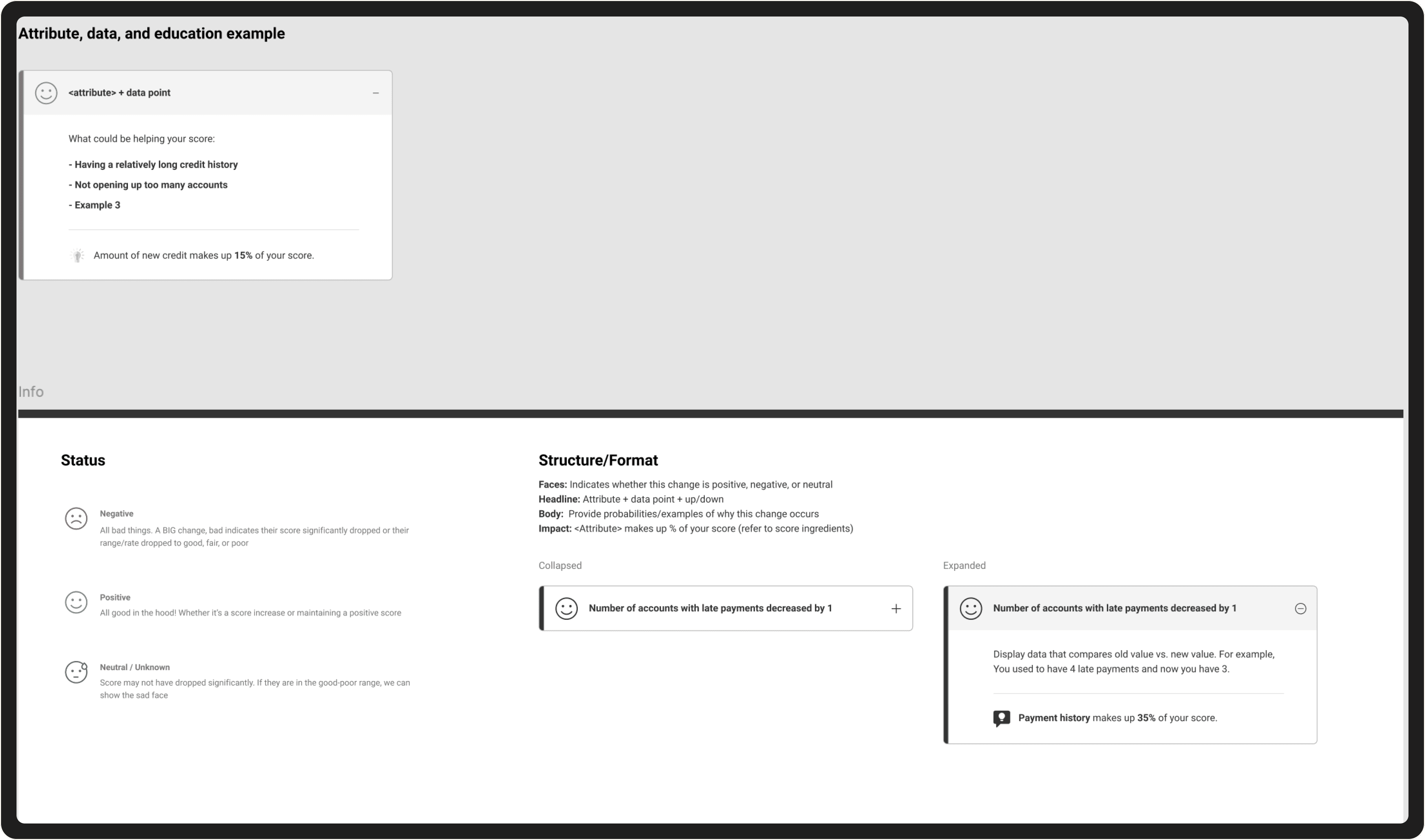

Transform complex FICO data into meaningful insights that consumers could actually understand.

Worked closely with the lead product manager to decode credit data into plain language

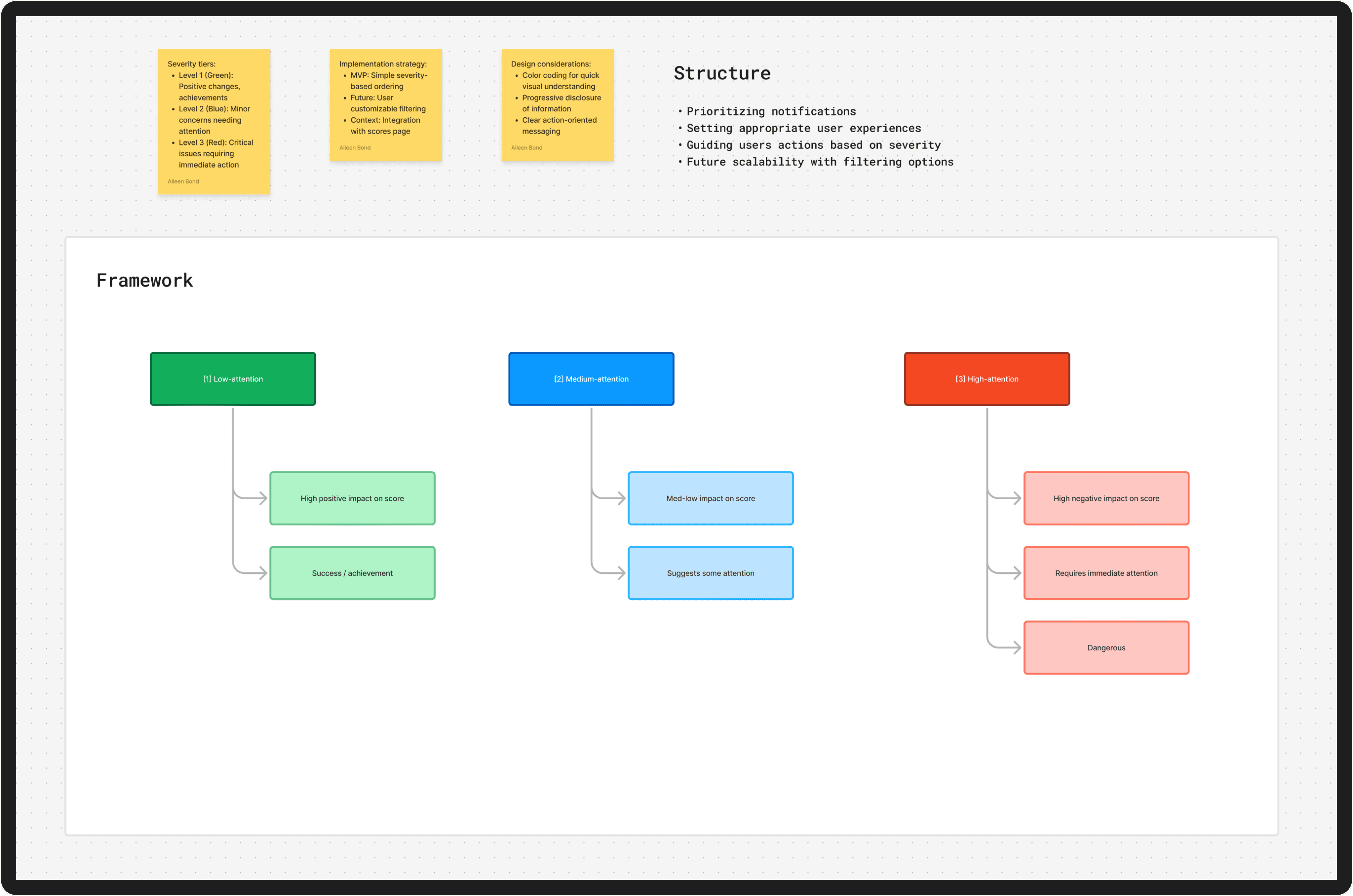

Created a framework to highlight positive and negative changes that affect scores. This wasn't just about color coding, this was about humanizing the Experian displays.

Green: Positive changes worth celebrating

Yellow: This might need your attention

Red: Urgent issue arising, immediate action required

Balanced comprehensive information with timely notifications, giving users both context and clear next steps exactly when they need them

Outcomes

The 'What's Changed' featured truly transformed how consumers understand and act on their credit score changes. The success was reflected in concrete metrics:

80% of users reported the feature significantly improved their understanding of score changes and necessary actions

30% engagement rate demonstrated strong user adoption and regular interaction

These results confirmed that by translating complex credit data into clear, actionable insights, we helped users take control of their credit health with confidence.